Buyers Guide to Purchasing a Home

🏡 The Buyer’s Journey: Navigating the Home Buying Process with Confidence

Buying a home is a thrilling milestone, but it can also feel overwhelming—especially for first-time buyers. Whether you're upgrading, downsizing, or diving into homeownership for the first time, understanding the buyer’s side of the home buying process will help you move forward with clarity and confidence.

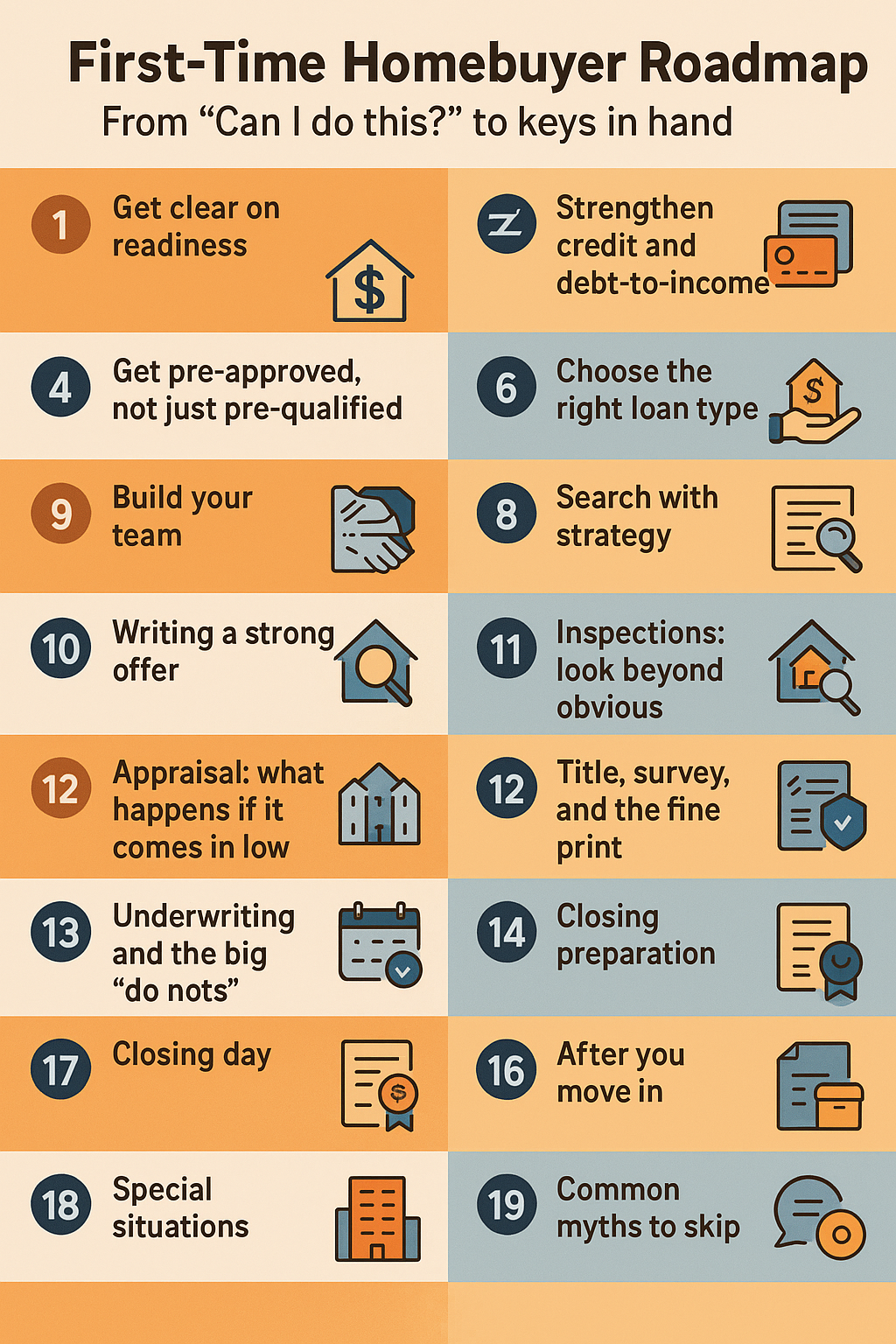

Here’s a step-by-step breakdown of what you can expect:

1. Get Pre-Approved for a Mortgage

Before falling in love with a home, know how much you can afford. A mortgage pre-approval gives you a clear price range and shows sellers you're a serious buyer. Work with a reputable lender who can explain your options and find the best loan program for your needs.

✅ Tip: Don’t just look at the monthly payment—consider property taxes, insurance, and HOA fees, too.

2. Choose the Right Real Estate Agent

A buyer’s agent is your advocate throughout the transaction. They’ll help you find homes, schedule showings, negotiate offers, and manage paperwork. Look for an agent who’s knowledgeable about your local market, listens to your goals, and communicates clearly.

3. Make Your Wish List

Think about what matters most: location, school district, square footage, number of bedrooms, outdoor space, commute time, etc. Prioritize your “must-haves” versus “nice-to-haves” so your search is efficient.

✅ Pro Tip: No home is perfect, but the right one will check most of your boxes.

4. Start the House Hunt

This is the fun part! Your agent will help you schedule tours, explore neighborhoods, and compare listings. Keep an open mind—sometimes a home might surprise you in person compared to photos.

✅ Red Flags: Pay attention to signs of poor maintenance, odd smells, or rushed flips.

5. Make an Offer

When you find “the one,” your agent will help you craft a competitive offer. This includes the price, closing timeline, earnest money deposit, and any contingencies (like inspection or financing).

✅ Strategy: Your agent will analyze market conditions and recent sales to guide your offer.

6. Home Inspection & Appraisal

Once your offer is accepted, schedule a home inspection. This uncovers any hidden issues with the property. You can then negotiate repairs, ask for credits, or walk away if needed. Meanwhile, the lender will order an appraisal to ensure the home is worth the purchase price.

✅ Peace of Mind: A good inspection protects you from surprises down the road.

7. Finalize Financing

Your lender will verify all financial documents, finalize your loan, and issue a “clear to close.” Stay responsive during this time and avoid big financial changes (like opening new credit lines or changing jobs).

✅ Checklist: Make sure you've submitted everything the lender requests on time.

8. Closing Day!

You’ll sign the final paperwork, transfer funds, and officially become the new owner. This process usually takes 1-2 hours. Once everything’s recorded with the county, the keys are yours!

✅ Celebration Time: Welcome home! 🏠

Final Thoughts

Buying a home is one of the most rewarding investments you’ll ever make. With the right preparation, a trusted real estate agent by your side, and a clear understanding of the steps, you’ll be ready to make smart decisions and enjoy the journey.

If you're ready to take the next step—or just want to talk through your options—let’s connect! I'm here to guide you every step of the way.